With your Lexi Rating

Understand your Cyber Insurability in Minutes

SMEs without a Lexi Rating™ may face higher premiums or outright denials. Before you apply for cyber insurance, know exactly how you’ll be judged. Get your Lexi Rating now

See what insurers see, before they do!

Instant Report

No Credit Card Needed

Get Actionable Steps To Improve Your Security

Discover How Much Cyber Coverage You May Need

Qualify For Cheaper Insurance

Meet LEXI Rating

The Cyber Insurability Rating designed for Small Businesses

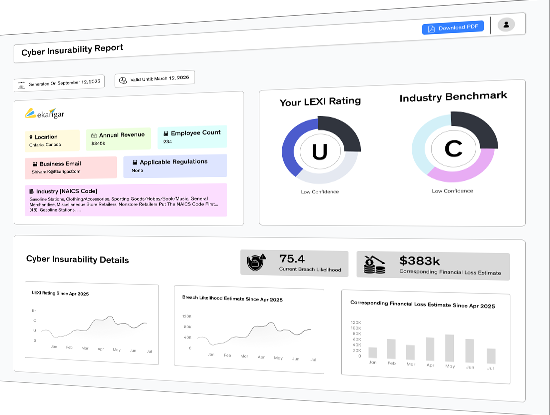

LEXI Rating is the world's first cyber insurability rating built specifically for micro and small businesses. It's like a credit rating - but for cyber insurability.

Your Lexi Rating provides you with:

Industry Benchmarking

Find out how your insurability compares to others in your sector.

Confidence Levels

See how confident we are in your results, based on data quality and assessment depth.

Breach Likelihood

Statistical probability of a material cyber attack based on your current posture.

Financial Loss Estimate

Projected costs if a breach occurs, including downtime and recovery.

Historical Trend Tracking

As you participate over time, monitor how your insurability posture improves.

Insurance Coverage Gap

Specific vulnerabilities and missing protections in your current setup.

Real Time Results

Instant results all in a fast, frictionless process.

Personalized Security Recommendations

Actionable steps to improve your security posture and rating.

What Does LEXI Rating Mean?

The Lexi Rating™ is an independent, standardized measure of a company’s cyber insurability. Lexi Rating™ evaluates cyber risk posture and translates it into a score that insurers understand. It benchmarks SMEs against industry norms, using data on security practices, controls, incident history, and resilience. You can use your Rating & Insurability report to negotiate better premiums, and minimize the risk of denial of coverage.

A+

Exceptional

You're extremely well-protected, with proactive controls and trained staff. Insurers see you as a top-tier candidate.

A

Excellent

Strong cybersecurity controls and low overall risk. A solid position in the eyes of underwriters.

A-

Very Good

You're above average and nearly insurer-ready. A few improvements could unlock better pricing or coverage terms.

B+

Insurable

You're generally in good shape, but minor vulnerabilities may increase costs or limit coverage options.

B

Acceptable

Coverage likely, but underwriters will have concerns. Your security foundation is sound but uneven.

B-

At Risk

such as You lack key controls insurers require -MFA, secure backups, or endpoint protection.

Uninsurable. Critical Gaps

You don't currently meet minimum standards for coverage but improvement is absolutely possible.

How It Works

Answer Few Questions

Complete a short questionnaire about your business and current security practices

(Optional) Upload existing security assessment

Upload either a Pen Test, CIS Assessment or a Sig Lite Assessment

See Your Report

Receive your LEXI Rating, Coverage gap analysis & a comprehensive cyber Insurability Report

Review & Take Action

Follow clear next steps to strengthen your posture - and see your LEXI Rating update as you improve.

Trusted by Small Businesses

4.9/5 average rating

Used by 1000+ SMBs

Backed by cybersecurity and insurance experts

Frequently Asked Questions

Get Your Free LEXI Rating Today

Join over 1,000 small businesses who have improved their cyber insurability with Lexi Ratings